Middle East and North Africa (MENA) countries are increasingly using agriculture technology to address food security challenges. Pre-existing pressures, such as water scarcity, lack of agricultural land, population growth, political instability, and regional conflict have been further exacerbated by global challenges, with the war in Ukraine, the fallout of the COVID-19 pandemic, and global inflation all contributing to soaring food costs. Innovations in “agritech” can help transform the region into one with greater food system resilience and more sustainable water usage. Saudi Arabia and the United Arab Emirates (UAE) are spearheading the sector’s regional development, making sizable investments in ventures that leverage big data and innovative farming techniques to help reduce reliance on food imports. Improvements in digital infrastructure and access to finance can help the region take advantage of agritech while encouraging intra-regional investment.

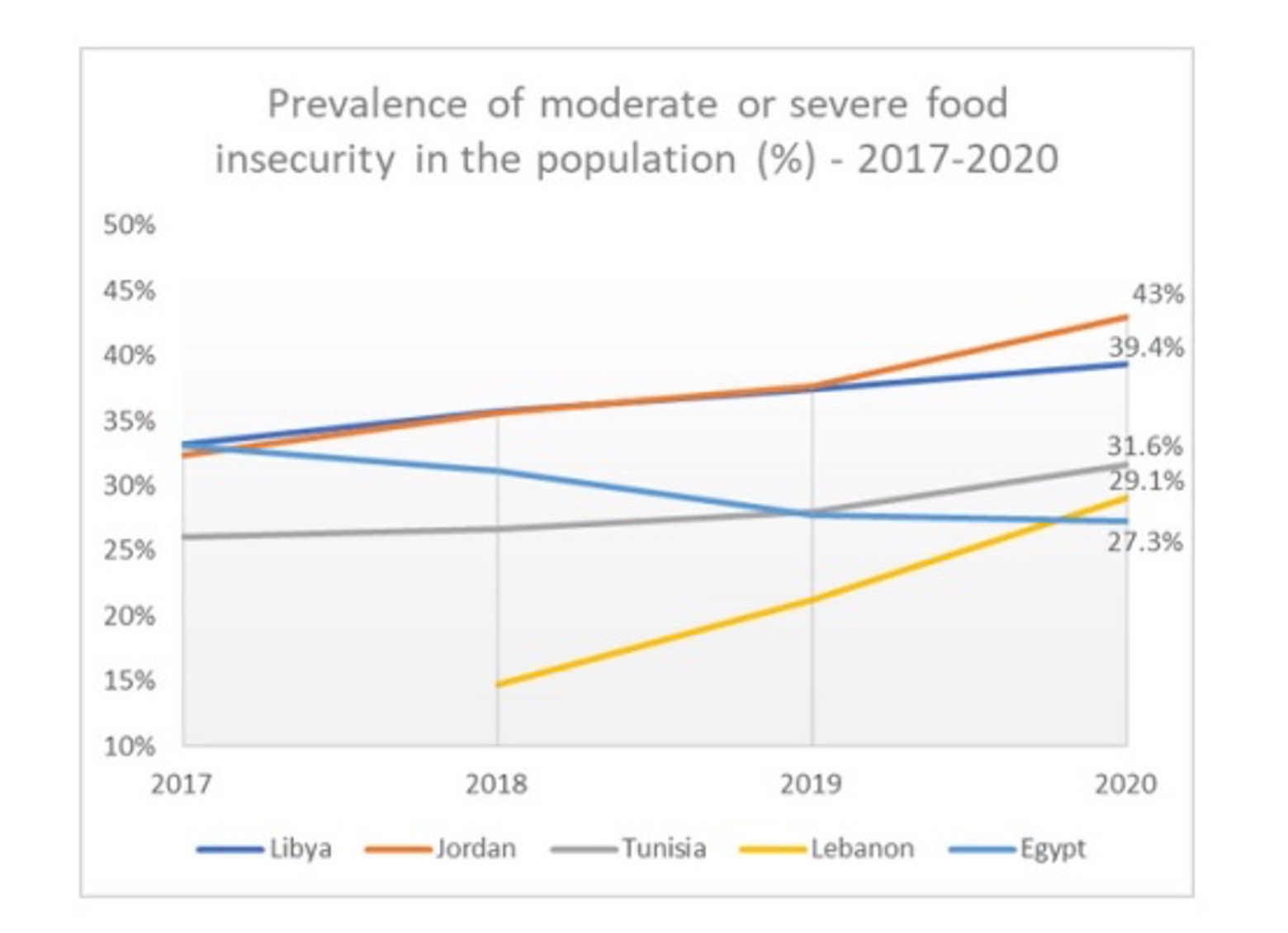

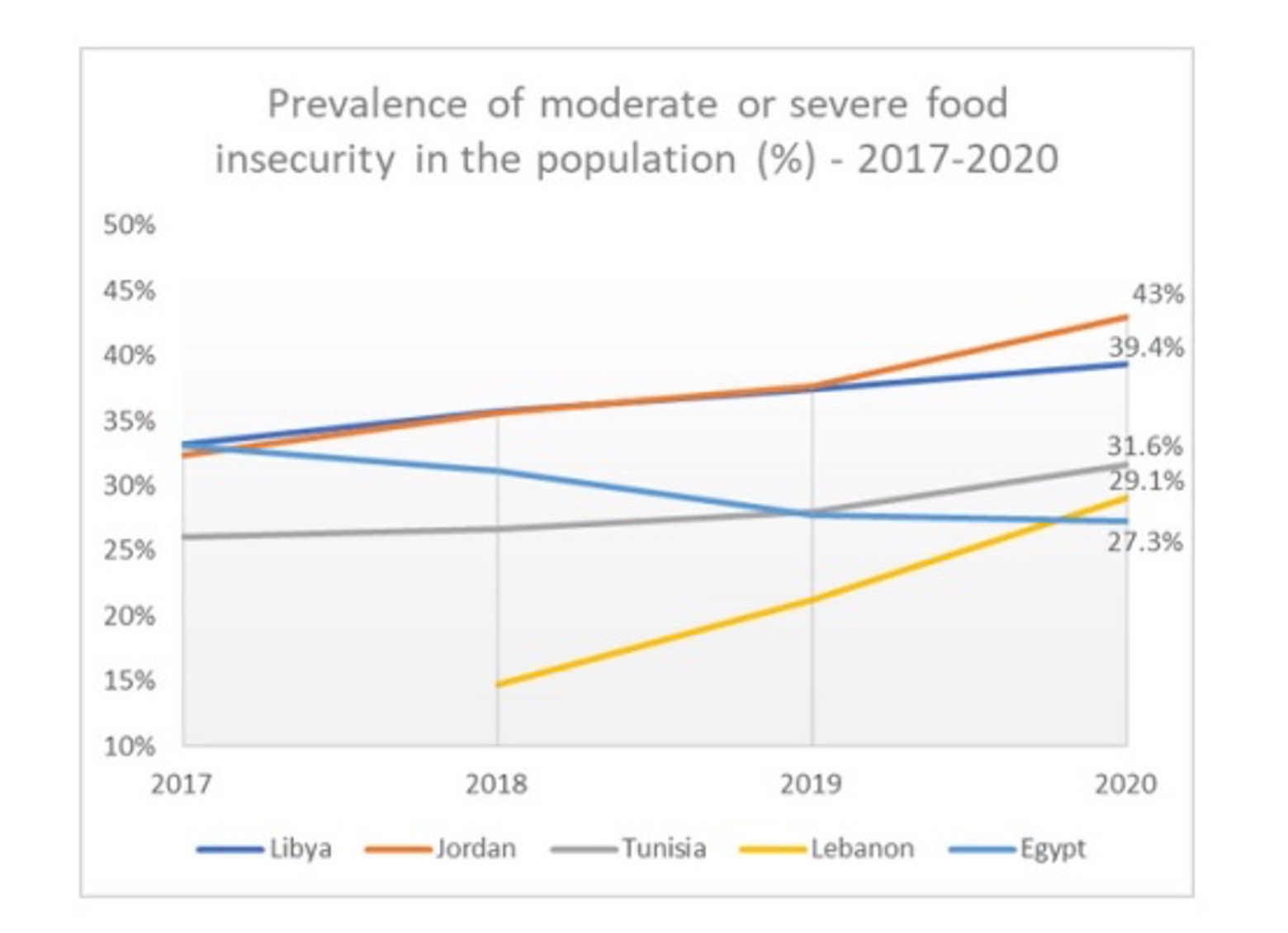

As most of the world grapples with pressing food security challenges, the MENA region faces a unique situation. Taken as a whole, the region has the lowest level of food self-sufficiency, is the world’s largest food importer and boasts the biggest water deficit. Syria and Yemen ranked in the bottom three countries globally in the 2022 Global Food Security Index (GFSI). Excluding Gulf Cooperation Council (GCC) countries, year-over-year trends in the region through 2020 show a worsening trajectory.

Source: World Bank

Regional countries are thus in an increasingly difficult position as a global recession looms and as climate change exacerbates local challenges. This has helped lead to a push to reduce high reliance on imports and food subsidization, particularly in the capital-rich GCC, where an average of 90% of food products are imported. Imports and subsidies could be reduced by strengthening trade links and supply chains, and encouraging local agricultural production. However, producing more food locally would be costly due to limited access to water—some 85% of fresh water in the region is already used for agriculture. For this reason, policymakers are increasingly looking toward agritech to address food insecurity.

Agritech takes off in MENA, led by Saudi and UAE

The agritech sector focuses on developing technologies to boost agricultural productivity. This includes developing new seeds and fertilizers, using artificial intelligence (AI) and robotics to increase crop yields, and using drones to monitor and manage crops. Major advancements in AI and greatly expanded computing capacity have laid the groundwork for agritech to help ensure resilient food systems. Agritech companies have seen substantial growth globally and have begun to take hold in the MENA region. The volume of agritech investments in the MENA region saw a compound annual growth rate of 122% between 2018 and 2021, with funding in the sector rapidly increasing since 2020. The sector is set to continue to grow steadily, with aggregated funding across the MENA region having jumped to $250 million in 2022 from $97 million in 2021. While agritech venture capital in MENA is still relatively small compared with other regions, investments in the region as a share of global agritech investments increased to 4% in 2022 from 1% in 2021.

India’s energy needs are intrinsically linked to its economic transformation. As the world’s fastest growing economy, India is estimated by the IMF to become the third largest by 2027 in part due to its plans to become the “factory of the world” through its “Make in India” programme. As countries and companies shift away from dependence on China – for political and business confidence reasons – and China itself moves toward consumption-led growth, India is poised to become a global manufacturing centre.

In the UAE, the government is making significant investments in agritech companies as it looks to reduce imports through vertical farming, hydroponics, and patented technology that helps track harvests. The Abu Dhabi Investment Office (ADIO) set up a $200 million fund to invest in a range of early-stage companies over the coming years, with a large increase in investment in 2022.

Agritech companies have adapted to the needs of individual nations, seeing growth across the region. In Egypt, companies are using the ubiquity of smartphones to aid farmers, launching apps that provide a variety of agriculture services. For example, some apps enable direct access to microfinance and aid to puchase agriculture products, while others connect farmers with storage facilities to help aggregate crop storage and reduce costs. This more low-tech approach is finding success across the region.

Challenges and Opportunities

The agritech sector still faces barriers to access. For many MENA countries, these include insufficient access to digital technology and data, a lack of financial resources and supporting infrastructure, and few policies that promote agritech innovation. There has been significant technological progress in recent decades, though many countries still lag behind. For instance, the UAE and Kuwait have higher access to digital technology than countries such as Yemen and Lebanon, thereby inhibiting equitable and widespread innovation. Over time, humanitarian aid and FDI can help reduce the gap. For example, Saudi Arabia has been a key supporter of the United Nations’ International Fund for Agricultural Development (IFAD), having contributed over two-thirds of its total development assistance from MENA countries.

Agritech companies also rely on data for success. Data, such as information generated throughout supply chains, can help drive data-backed strategies for efficient crop growth, allowing farmers to maximize their resource usage. For agritech startups to be successful, governments need to invest in data collection and sharing, and develop policies that ensure data privacy and security while allowing for its commercial use. However, agricultural data is often not available in the MENA region, either because it is not collected in a systematic way, or due to restrictions—often government regulation—and security concerns.

Finally, access to financing is a major barrier to agritech development. Many of the region’s startups are small and lack the financial resources to fund their own research and development. Additionally, many startups are not yet profitable and need funding to scale up their operations. Regional governments can play an important role in providing financial resources to these startups, either by enacting policy changes to support startups or through direct grants and investments.

The innovative agriculture approaches taking place across the region, while still in a nascent stage, have paved the way for major advances in ensuring food security. Agritech has already helped reduce imports and enable more sustainable water usage. This important sector can steadily reach fruition so long as governments continue to invest in technology, enact policies that support innovation, and encourage collaboration between regional countries across the income scale. Technology may not be the sole answer to food insecurity, but as part of a comprehensive blueprint it can be a key contributor to more resilient food systems.